The stock market’s reaction to United debacle vs a school shooting

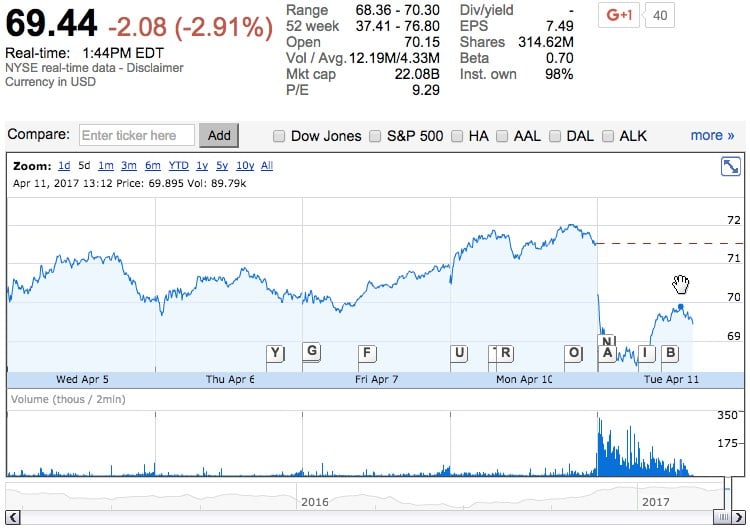

Yesterday, a video of a man dragged from an overbooked United flight because he wouldn’t give up his seat went viral. Public reaction to the incident and United’s subsequent fumbling of the aftermath has resulted in UAL’s stock falling several percentage points this morning:

The stock has rebounded slightly this afternoon and will probably fully recover within the next few weeks.

Also yesterday, a man walked into a San Bernardino elementary school and killed a teacher (his estranged wife) and an 8-year-old boy before shooting himself. The story has received very light national coverage, particularly in comparison to the United story. In response, the stock prices of gun companies were up a few percent this morning (top: American Outdoor Brands Corp which owns Smith & Wesson; bottom: Sturm, Ruger & Company):

This follows a familiar pattern of gun stock prices rising after shootings; Smith & Wesson’s stock price rose almost 9% after the mass shooting in Orlando last year.

Update: It took about three and a half weeks, but on May 2, United’s stock had regained all of the value “lost” due to the incident and subsequent PR blunders. As of this writing (May 3 at 12:41 PM ET), UAL is actually up about 3.5% from the closing price before the incident.

Stay Connected